Navigating the rental market can feel overwhelming, especially when it comes to understanding the various costs involved. From monthly rent to hidden fees, potential tenants often find themselves puzzled by the total expenses tied to a new lease. A clear breakdown of rental costs is essential for making informed decisions and budgeting effectively.

This article dives into the key components of rental costs, shedding light on what to expect beyond just the rent payment. By exploring factors like utilities, maintenance fees, and security deposits, readers will gain a comprehensive understanding of their financial obligations. Armed with this knowledge, they can confidently approach their next rental agreement without any surprises.

Table of Contents

ToggleUnderstanding Rental Cost Breakdown

Understanding rental costs involves recognizing both the base rent and additional financial obligations. This knowledge empowers tenants to budget effectively and avoid unexpected expenses.

Factors Influencing Rental Costs

- Location: Rental prices significantly fluctuate based on geographic areas and neighborhoods. Urban properties typically incur higher rents than suburban or rural options.

- Property Type: Apartments, single-family homes, and townhouses exhibit varying rental rates. Larger properties often command higher rents due to more amenities and space.

- Market Demand: A high demand for rentals in specific regions elevates prices, while oversupply can lower them. Seasonal trends, such as summer relocations, also impact rental costs.

- Amenities: Properties with added features such as pools, gyms, laundry facilities, or parking tend to have elevated monthly rents. The more amenities offered, the higher the associated costs.

- Lease Terms: The length of the lease influences rental prices. Shorter leases may involve higher monthly rents compared to longer-term agreements.

- Condition and Upgrades: Recently renovated or newly built properties often attract premium prices. Landlords may charge additional rents for upgraded kitchens or bathrooms.

Importance of Rental Cost Breakdown

- Budget Planning: A detailed rental cost breakdown facilitates accurate budgeting, clarifying how much tenants allocate for monthly housing expenses.

- Informed Decisions: Understanding all associated costs helps tenants evaluate rental offers better, ensuring they select a property that fits their financial capacity.

- Negotiation Leverage: Familiarity with typical costs in a given area equips tenants with information for rent negotiations, guiding discussions on reasonable pricing.

- Avoiding Surprises: Knowing additional fees like utilities, maintenance, and security deposits prevents unexpected financial burdens after signing a lease.

- Long-term Financial Health: A comprehensive understanding of rental costs aids in fostering financial discipline, ultimately promoting stability in one’s housing situation.

Types of Rental Costs

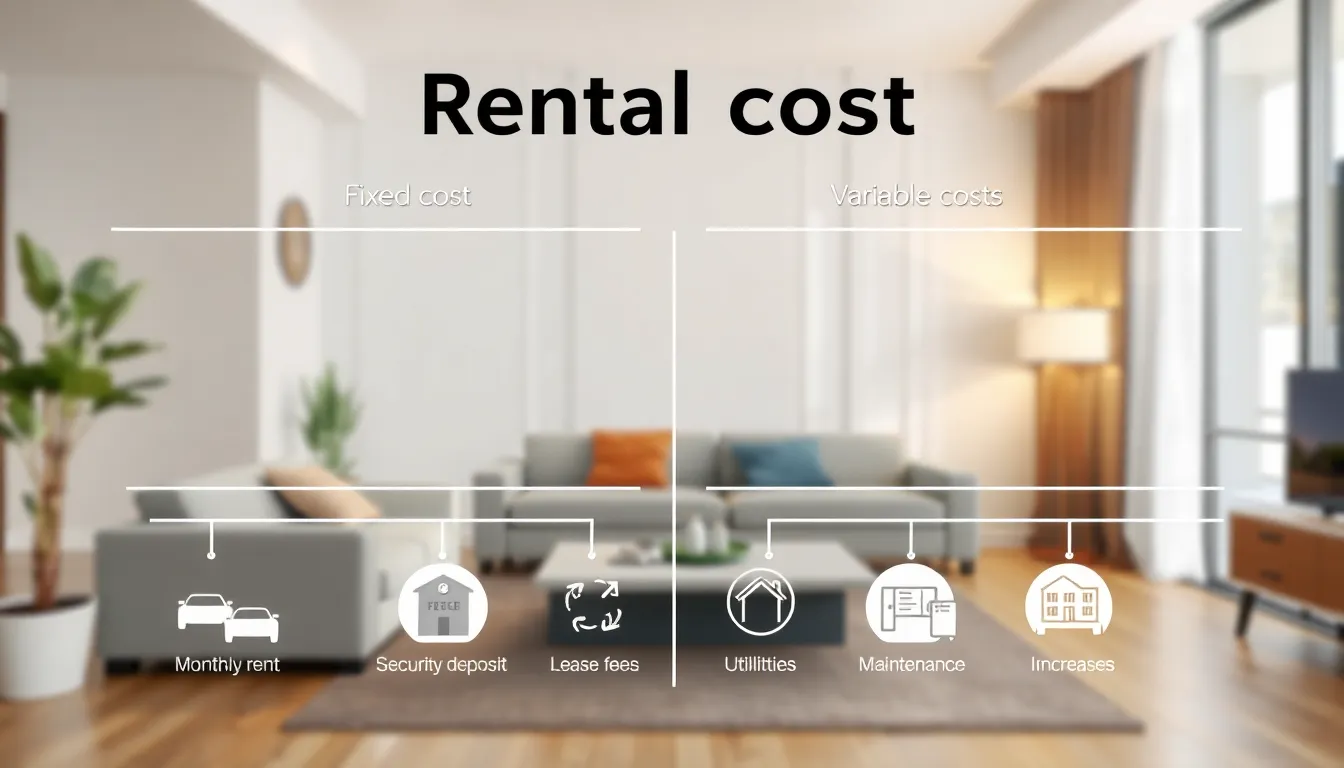

Understanding the various types of rental costs helps tenants manage budgets effectively. These costs generally fall into two categories: fixed costs and variable costs.

Fixed Costs

Fixed costs remain static throughout the rental period. Common examples include:

- Monthly Rent: This primary expense is predetermined in the leasing agreement and paid regularly.

- Security Deposit: Required upfront, this deposit typically equals one month’s rent. Landlords hold it until the lease ends to cover damages or unpaid rent.

- Lease Fees: Some landlords charge administrative fees for processing rental agreements, often one-time payments.

Variable Costs

- Utilities: Electricity, water, gas, and internet costs depend on individual consumption, leading to unpredictable monthly bills.

- Maintenance Fees: In properties managed by associations, tenants may pay variable fees for ongoing maintenance, which can change based on service requirements.

- Rent Increases: Lease agreements may specify conditions when rent can increase, making costs variable depending on market conditions or lease renewal terms.

Analyzing Rental Cost Components

Understanding the key components of rental costs helps tenants budget effectively. A comprehensive breakdown includes base rent, additional fees, and utilities and maintenance.

Base Rent

Base rent represents the core monthly charge for leasing a property. This amount varies significantly based on location, property type, and amenities included. Urban properties often command higher base rents due to demand. On average, base rent accounts for 30% to 50% of a tenant’s total housing cost. For example, a studio apartment in a city center may cost $2,000 monthly, while a similar unit in a suburban area might only be $1,200. Evaluating comparable properties offers valuable insights into fair rental pricing.

Additional Fees

Additional fees encompass various charges that can inflate overall rental costs. Common additional fees include:

- Security deposits: Typically one month’s rent, refundable barring damages.

- Pet fees: Non-refundable amounts for tenants with pets, varying from $300 to $500.

- Application fees: Costs to process rental applications, ranging from $30 to $100.

- Parking fees: Monthly charges for on-site parking, which can range from $50 to $300.

These fees can significantly impact budgeting, with some properties requiring multiple additional fees before moving in.

Utilities and Maintenance

Utilities and maintenance represent ongoing costs that vary by property and usage. Utility expenses generally include:

- Electricity: Average monthly bills run from $100 to $200, depending on usage.

- Water: Water costs for most apartments range from $30 to $70 monthly.

- Gas: Natural gas heating can add $50 to $150 monthly.

Maintenance fees often include regular upkeep and unexpected repairs. Some landlords charge maintenance fees, while others require tenants to handle minor repairs. Tenants should clarify these expectations in the lease agreement, ensuring a clear understanding of responsibilities related to utilities and maintenance costs.

Tips for Evaluating Rental Costs

Evaluating rental costs requires a systematic approach to ensure financial decisions align with budgetary constraints. Below are strategies for effective evaluation.

Comparing Rental Options

- Establish criteria: Determine essential features such as location, number of bedrooms, proximity to amenities, and public transportation availability.

- Research market rates: Analyze local rental listings to identify average rates for similar properties, using websites like Zillow or Apartments.com.

- Consider total cost: Examine all associated costs, including utilities, maintenance, and additional fees. Total expenses should factor into comparisons.

- Utilize a spreadsheet: Create a comparison table to list various options side by side, allowing easy evaluation of key components like base rent and extra charges.

- Inspect properties: Visit prospective rentals to assess their condition and amenities, providing a clearer view of whether they justify their costs.

Negotiating Rental Prices

- Gather market data: Present data-backed arguments utilizing comparable listings that showcase lower rental prices for similar properties in the area.

- Highlight your advantages: Emphasize being a reliable tenant with a solid rental history, stable income, and good credit to enhance negotiating power.

- Be flexible: Show willingness to negotiate lease terms, such as longer rental durations or prepaying several months’ rent, which can entice landlords to lower prices.

- Request concessions: Ask for waivers on specific fees, like application fees or security deposits, to mitigate overall costs while not altering base rent.

- Follow up timely: Communicate openly with landlords after discussions, demonstrating commitment to the negotiation process while reinforcing interest in the property.

Understanding the rental cost breakdown is crucial for anyone navigating the rental market. By recognizing both fixed and variable expenses tenants can create a realistic budget that accommodates all potential costs. This knowledge not only aids in financial planning but also equips tenants with the confidence to negotiate better terms with landlords.

Awareness of the factors influencing rental costs can lead to more informed decisions. With the right approach and tools tenants can avoid unexpected financial burdens and secure a rental agreement that meets their needs. Ultimately a thorough grasp of these costs lays the foundation for a stable and satisfying rental experience.